National insurance bills, which were pushed up by higher rates in April, went down on 6 July as the threshold increased.

The impact of this on your finances will depend on how much you earn. Those on lower incomes will make some welcome savings from July 2022, while higher earners will pay more compared to 2021/2022.

What is national insurance?

National insurance is a tax paid on earnings by employees and employers and paid by the self-employed on profits. It was introduced back in 1911 to support workers who had lost their jobs or needed medical treatment, and later expanded to fund the state pension and other benefits and contribute towards the NHS.

The government can also borrow from the national insurance fund to pay for other projects.

National insurance contributions are mandatory for people aged 16 or over, up until state retirement age, provided you earn over certain limits.

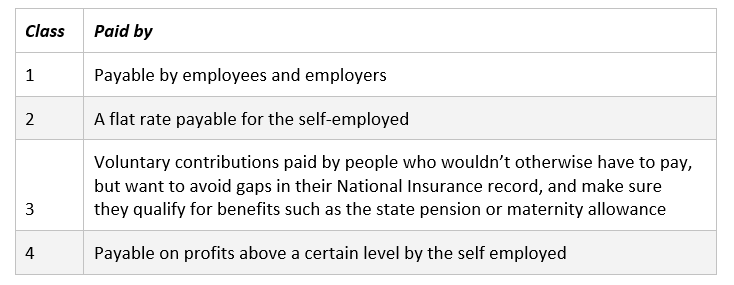

There are four main types of national insurance:

New national insurance rates

At the start of the new tax year on 6 April, workers started paying more national insurance.

The rate at which you pay national insurance has increased by 1.25%. This means that from 6 April workers saw their national insurance contributions rise from 12% to 13.25%.

Earnings above £4,189 a month (£50,270 per year) are usually subject to national insurance deductions of 2%. But from 6 April this increased to 3.25%.

National insurance threshold rising from July

From 6 July the national insurance threshold, which is the level of earnings at which you start making contributions, became the same as the income tax threshold (known as the personal allowance). It means you no longer pay national insurance or income tax if you earn below £12,570 a year. That’s an increase from the previous NI threshold of £9,880 which came into force in April 2022, (the threshold in the 2021/22 tax year was £9,588)

Increasing the threshold means fewer workers will get caught in the national insurance net, meaning they will have more money in their pockets.

If you earn more than the threshold, you will still feel the benefit as you will pay less national insurance overall.

For anyone earning just under £40,000 or less, the higher threshold will repair the damage inflicted by the national insurance hike in April. So, 70% of people will see their NI drop below what they were paying before April’s rise. However, higher earners will pay more.

Why has the national insurance rate gone up?

A new health and social care levy came into force in April 2022 which increased your NI bill, provided you earn enough to pay national insurance.

Employees saw their NI contributions increase to 13.25% from 12%. Earnings of more than £4,189 a month are subject to national insurance at a rate of 3.25% instead of 2%.

Employers’ contributions have jumped from 13.8% to 15.05%.

From April 2023, NI will revert to its old level but a new Health and Social Care Levy, at that same 1.25% rate, will be paid separate to national insurance contributions, becoming a tax in its own right.

There are also increases on the way for pensioners. Pensioners who are still working after the state pension age (currently 66) don’t pay national insurance. However, from April 2023 the new levy will be deducted from their earnings. This means that from April 2023 pensioners will have to pay the new levy on their earnings if they are still working.

What do the NI changes mean for my pension?

Your national insurance record affects the amount of state pension you are entitled to.

About 2.2 million people will no longer pay national insurance at all due to the raising of the threshold in July. However, people who no longer earn enough to pay national insurance won’t necessarily miss out on state pension credits.

This is because lower earners should still rack up qualifying years for the state scheme if their income is above the “lower earnings limit” with one employer, which is currently set at £123 a week – equivalent to £6,396 a year. Meanwhile workers will continue to build up national insurance credits if their profits are above the “small profits threshold” of £6,725 for the 2022/23 tax year