What’s happening to Dividends and Capital Gains Tax?

You may have heard about the changes Jeremy Hunt announced in the

recent Budget on Dividends and Capital Gains Tax (CGT), with the annual

thresholds being cut from April 2023. But what does it mean for you?

Dividend Tax

Firstly, what is a dividend?

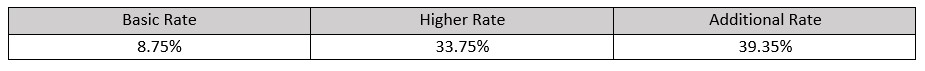

A dividend is a payment made to you from a stock or investment and is based on the companies’ annual profits. The amount you can receive tax free depends on the annual dividend allowance (currently £2,000), so any amount you receive over this value will be taxed depending on your income tax band:

What do the changes mean for you?

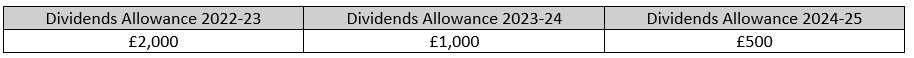

If you receive regular dividend payments, you will most likely be affected as the amount you can receive tax free from 2023 will be much lower than it is now. For example, if you currently receive £2,000 in dividends each year, from April 2023 you will pay tax on half of this payment, and then from April 2024 only £500 of this payment will be tax free.

The table below illustrates how the allowances are due to change over the next two years:

Capital Gains Tax (CGT)

What is CGT?

CGT is the tax you pay on the disposal of any gains made over the

annual threshold (currently £12,300).

Depending on your taxpayer status, the amount of CGT you pay will

vary, with basic rate taxpayers paying 10% tax on gains, and higher and

additional rate taxpayers paying 20%. These rates also increase by an

additional 8% when the gain is from the sale of a property.

So, how could this affect you?

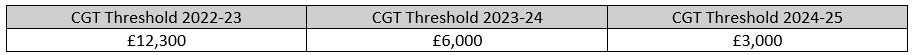

Due to the reduction in the CGT exemption, the amount of profit

you can realise tax free from, for example, a General Investment Account will

be reduced significantly. The table below illustrates how the CGT allowance is

due to change over the next two years:

*TOP TIP*

These changes take effect from April 2023, so if you have any gains to realise within your General Investment Account, now might be the best time to do it as you will still qualify for the £12,300 exemption.

Should you have any specific questions regarding your own situation, please speak with your Financial Adviser.