EVERYBODY PANIC!

Over the past few weeks you will have seen alarming newspaper and television articles. We’ve all seen the headlines – “inflation reaches 30-year high” “inflation could hit 8/9/10%”

Every time you fill up your car, visit your local supermarket, or receive your gas or electricity bill you can be in no doubt that costs are significantly higher than they were a year ago. The Office for National Statistics (ONS) predicts that standards of living in the UK will take their biggest hit since 1956.

The extent to which this affects our day-to-day lives will vary enormously, and clearly many people are struggling desperately with keeping their physical and mental lives afloat.

I could talk about what might be done about this, but that is unlikely to help my or your blood pressure, so in this article I want to focus on how we, at Serenity, are responding with regard to the cashflow modelling we share with you. Something over which we do have control.

We’ve been asked by concerned clients – ‘why are you still using an assumed inflation rate of 3.0%, when we’re hearing on the news that it is now three times that level, and likely to go even higher?’

It’s important to remember that cashflow models are long-term illustrations of one potential financial future, so the assumptions we make in our models are intended to reflect this. If we are projecting 20, 30, 40+ years of your future, it seems sensible to look at what inflation has been doing over a similar period.

There are many measures we could use to measure inflation, but for now I’ve chosen to use the Retail Price Index (RPI). This is because the scary headlines of “inflation hits 8.2%” are referring to that, not the Consumer Prices Index (CPI), which is currently 6.2%.

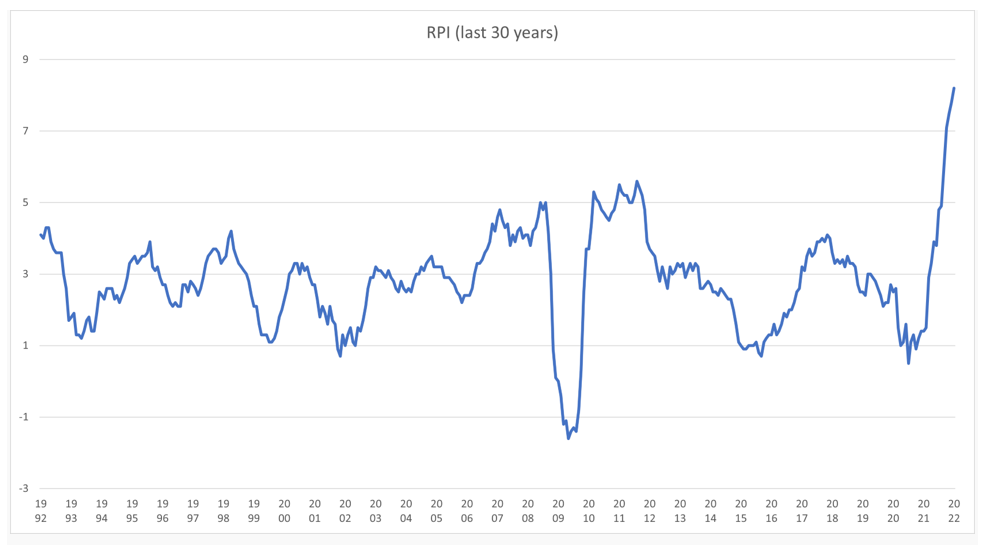

The graph below shows what has happened since 1992.

As you can see, it’s been a pretty bumpy 30 years. RPI has been as low as -1.6% and as high as 8.2%. It would not be very helpful in planning if we were to be continually changing our long-term assumptions based on short-term data. The 30-year average of the RPI is 2.83%.

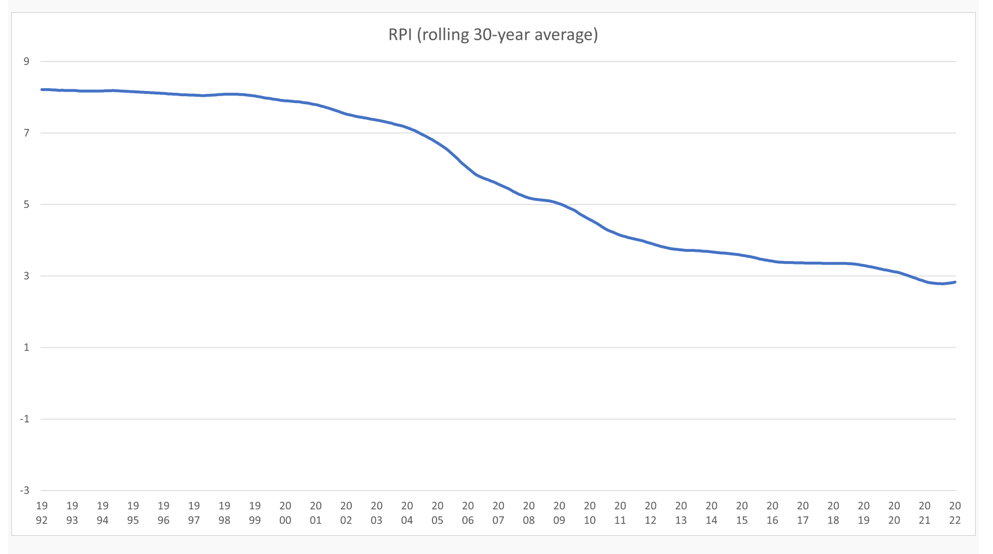

The thing about long-term trends is that they change slowly, a bit like a freight ship turning around. Here’s what the rolling- 30-year average of the RPI looks like, over the same period:

You can see the little uptick at the end as the long-term average is trending back towards 3%.

So, what’s going to happen in the next couple of years and how will that impact what we do with clients’ cashflow models?

The Office for Budget Responsibility (OBR) forecast that CPI will peak at 8.7% in the final quarter of 2022, so if we assume RPI continues to be a couple of percentage points above CPI, this could mean RPI rates of nearly 11%!

BUT (and it’s a big “but”) both OBR and the ONS agree that inflation will return to the Bank of England’s target of 2% within the next 12 months because this isn’t a result of a long-term trend, but rather a short-term shock.

We could argue that their ideas of ‘short-term’ have lengthened somewhat over recent months, so we do have to be slightly sceptical around timing, and clearly if you are 80 your view of short and long-term is markedly different to when you were 40, but I think the general principle is sound.

Don’t panic!

The likelihood that inflation will remain at over 8% for the long term is minimal, although that isn’t to say it will necessarily fall rapidly over the coming months.

You will have heard us say – several times for those who have been working with us for many years – that you should not sell or change your investments when financial markets fall. We tell you to hold tight and explain the long-term vision. Why should inflation be any different?

For the time being we will continue to use 3% as the most appropriate measure of inflation for planning purposes, although we can always prepare a scenario where inflation is assumed to be 3.5% or 4% rather than 3%, and review how that might affect your financial security.

That said, we will be keeping a close eye on developments. The next formal meeting of our Investment Committee is at the beginning of July, and our assumptions for inflation will certainly be on the agenda.