In December, we discussed the changes Jeremy Hunt had announced on Capital Gains Tax (CGT) and what it meant for you. Let’s recap…

What is Capital Gains Tax?

As a reminder, this is a tax charged on any profits you make from selling an asset, such as investments within your General Investment Account (GIA).

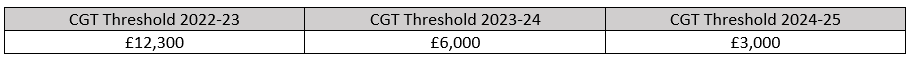

In recent years you have had an annual allowance of £12,300 which means you can make profits up to this limit each year without paying any tax. Any profits made above this threshold will be taxed at your marginal rate – 10% for basic rate tax payers and 20% for higher or additional rate tax payers. These rates also increase by an additional 8% when the gain is from the sale of a property.

So, what’s changing?

In April this year, the annual CGT allowance is being reduced significantly down to £6,000, and then down even further in 2024 to £3,000.

What do I need to do?

Following the announcement of these changes, we’ve had some clients asking if now the best time is to realise their gains. The answer is YES. And this is because until April, you are still able to realise £12,300 worth of gains tax free.

If you’re unsure on whether this applies to you, or you have any questions about this, please contact your Financial Adviser who will be happy to help.