The MAS report, ‘The Financial Capability of the UK’, points to evidence of how millions of people are adapting to deal with tough economic times and working hard to manage their money. It adds that despite people being understandably anxious about their finances, the evidence also shows how people have, over the past few years, become more careful with their money and more suspicious of financial scams.

For example, two in three respondents agreed that they were ‘very organised when it comes to managing money’. People are also checking bank statements more carefully – over half of the adults surveyed said that they regularly check all incomings and outgoings on their bank statements to keep track of their money. Two out of five look for suspicious transactions. Furthermore, almost nine out of ten adults now say they are saving.

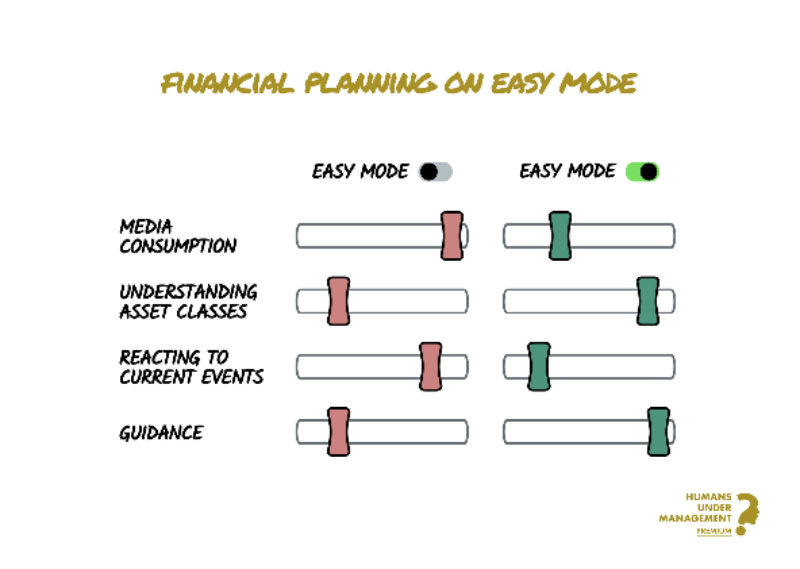

Despite the evidence of some positive behaviour, however, the study found many people have poor money skills and knowledge. For example, one in six adults was unable to identify the correct balance on a bank statement and one in three did not understand the impact of inflation on their savings. The MAS suggests that such people probably need to be helped to manage their money well so that they don’t make poor decisions that trap them in a vicious cycle of debt.

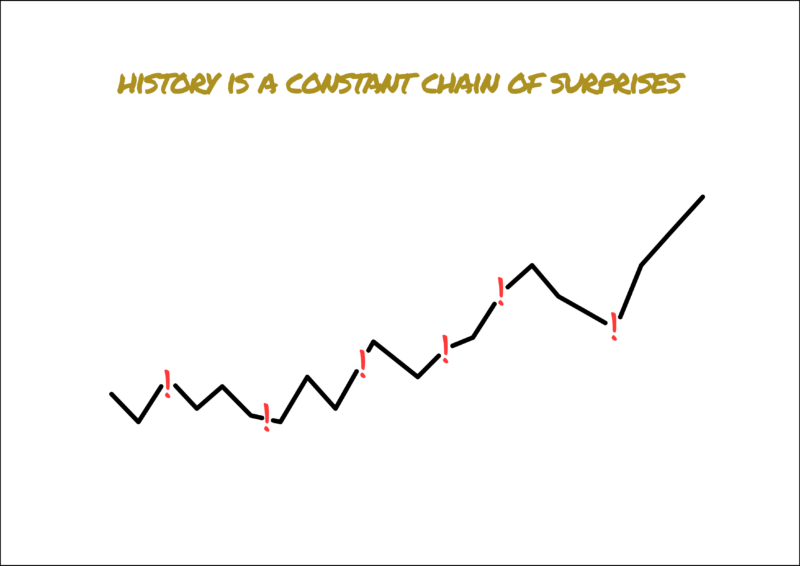

Everyone needs to make the most of their money so that, regardless of life’s ups and downs, they are not on the back foot but can reach their life goals.